Table of Contents

- Introduction

- What Are Shariah-Compliant Securities?

- Our Selection Process

- Revealing Our 3 Shariah-Compliant Securities

- Why a Shariah-Compliant Portfolio Stands Out

- How You Can Get Started

- Conclusion

Introduction

Investing is no longer just about chasing profits; for many, it’s also about aligning their financial decisions with their personal values. Whether you’re a seasoned trader or just starting out, the concept of ethical investing is gaining traction across the globe, appealing to both Muslim and non-Muslim investors alike. One compelling avenue within this space is Shariah-compliant investing—an approach rooted in Islamic principles that prioritize transparency, fairness, and ethical business practices.

In this blog post, we’ll share our personal Shariah-compliant portfolio, featuring three carefully chosen securities that reflect both our financial goals and commitment to ethical investing. These stocks not only adhere to Islamic principles but also offer promising opportunities for growth.

Thanks to the Philippine Stock Exchange (PSE) and its Shariah Stock Market Program, identifying Shariah-compliant securities has become more accessible. The PSE, in collaboration with IdealRatings, Inc., screens listed companies to ensure compliance with Islamic standards, providing investors with a reliable framework for ethical investing. If you’ve been curious about Shariah-compliant investments or are simply looking for a fresh perspective on building a values-driven portfolio, this guide is for you. Let’s dive in!

What Is Shariah-Compliant Securities?

Shariah-compliant securities are investment options that align with Islamic principles, governed by Shariah law. These securities exclude businesses involved in prohibited activities, such as those related to alcohol, gambling, pork, or interest-based lending. The focus is on ethical practices, fair trade, and social responsibility, ensuring investments are not only profitable but also principled.

The Philippine Stock Exchange (PSE) has taken a significant step in promoting ethical investing through its Shariah Stock Market Program. This initiative was developed to expand the stock market's reach and open up more opportunities for Muslim investors in the Philippines and abroad. With its commitment to aligning with the values of Islamic finance, the PSE ensures that investors can make informed decisions based on a reliable framework.

To achieve this, the PSE partnered with IdealRatings, Inc., a global leader in screening securities for Shariah compliance. IdealRatings evaluates listed companies based on rigorous standards, ensuring that their operations and financial practices adhere to Islamic principles. Through this collaboration, the PSE has identified a list of Shariah-compliant securities, which is readily available for investors seeking ethical investment opportunities.

Benefits

Investing in Shariah-compliant securities offers several benefits:

- Ethical Investment Climate: Shariah-compliant investments promote a culture of accountability and ethical governance, ensuring that businesses operate with integrity and fairness. This fosters trust among investors and encourages participation in a values-driven financial ecosystem.

- Global Appeal: The PSE's Shariah program positions the Philippine market to attract a share of the global Islamic funds, estimated at over USD 1 trillion. By creating opportunities for both local and international Islamic investors, it contributes to economic growth while adhering to ethical standards.

- Resilient Investments: Shariah-compliant stocks prioritize financial stability and avoid excessive leverage, reducing exposure to high-risk ventures. This ensures that investments are sustainable and resilient in the long term.

By investing in Shariah-compliant securities, you can align your financial goals with your values, supporting ethical practices while participating in the growth of the economy. For more information, you can refer to the PSE’s Shariah-Compliant Securities page, which provides a comprehensive list of companies screened for compliance.

Report Type: Compliant Philippine Securities as per

AAOIFIAs of Date: September 25, 2024

Prepared By: Ideal Rating Support Team

Our Selection Process

With the Philippine Stock Exchange (PSE) and IdealRatings already screening stocks for Shariah compliance, we were able to focus entirely on the technical aspects of stock selection. By analyzing candlestick patterns and leveraging moving average (MA) indicators, we identified opportunities that aligned with both our investment goals and the market's momentum.

Technical Analysis: Our Approach

Candlestick Patterns

Candlestick charts provided us with a clear picture of price movements and market sentiment. We focused on patterns to spot potential reversals or continuations of trends. These patterns were instrumental in timing our entries and exits for maximum efficiency.

Moving Averages (MAs)

We utilized the 20-day Moving Average (20-MA) and the 200-day Moving Average (200-MA) to assess short-term momentum and the broader market trend. Here’s how we applied these indicators in our accumulation strategy:

- 20-MA: The 20-MA helped us identify short-term momentum shifts and potential areas of consolidation where prices were stabilizing, allowing us to time our entries effectively.

- 200-MA: While the stocks we accumulated were trading below the 200-MA (indicating a broader bearish trend), this was not a deterrent. Instead, it provided us with opportunities to buy at discounted prices during phases of potential recovery or consolidation. We focused on identifying signs of narrowing gaps between the 20-MA and 200-MA, which often indicate weakening bearish momentum and a possible reversal.

Our strategy prioritized stocks that demonstrated improving momentum relative to their recent price movements, even if they were trading below the 200-MA. This allowed us to build positions in fundamentally sound securities at attractive price points with potential for future recovery.

Technique

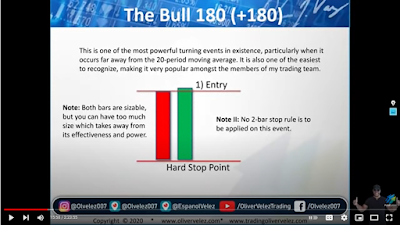

Inspired by techniques from Oliver Velez, we specifically analyzed candlestick formations for green "elephant bars" (strong bullish momentum) and red "bear elephant bars" (strong bearish momentum). These bars are significant indicators of potential market movement and play a key role in our trading decisions.

We paid close attention to the position of these bars relative to the 20-MA and 200-MA lines:

- A green elephant bar appearing above the 20-MA and 200-MA often signaled a strong bullish trend, especially if the moving averages were wide apart, indicating a healthy and sustained uptrend.

- Conversely, a red bear elephant bar forming below the 20-MA and 200-MA suggested bearish momentum, particularly when the MA lines were narrowing or overlapping, a sign of weakening support.

The distance between the 20-MA and 200-MA was also critical in our analysis:

- Wide gaps between the two indicators confirmed strong trends, either upward or downward, depending on the position of the bars.

- Narrowing or converging MAs indicated potential indecision or an approaching shift in market direction, prompting us to wait for clearer signals before committing.

This method helped us align our entries and exits with the prevailing market momentum, ensuring I selected stocks with the highest potential for growth while managing risk effectively.

For more details, you may check Oliver's YouTube video: The Ultimate Trading Strategy to Kickstart Your Journey in 2025.

State of the Market

In other words, Oliver Velez's concept of the Wide State and Narrow State describes two distinct conditions of the market based on price action and volatility. The Wide State occurs when the market is experiencing strong trends or significant volatility, characterized by large candlestick bodies and wide distances between moving averages (e.g., the 20-MA and 200-MA), signaling momentum and clarity in direction. Conversely, the Narrow State is marked by reduced volatility, smaller candlestick formations, and converging moving averages, reflecting market indecision or consolidation, often preceding a breakout or a major move. Understanding these states helps traders identify optimal entry and exit points by aligning their strategies with the prevailing market condition.

Balancing Risk and Opportunity

While technical analysis guided our decision-making, we also ensured that the selected stocks showed relatively low volatility while maintaining the potential for growth. This balance helped us build a portfolio that could withstand market fluctuations without compromising on long-term goals.

From Analysis to Selection

After applying these technical indicators to the PSE’s Shariah-compliant securities list, we narrowed down our choices to three stocks that exhibited strong technical signals and promising market trends. These securities not only satisfied our ethical considerations but also demonstrated favorable technical setups, giving us confidence in their inclusion.

Revealing Our 3 Shariah-Compliant Securities

As of December 31, 2024, our Shariah-compliant portfolio comprises three carefully chosen securities: Universal Robina Corporation (URC), DDMP REIT, Inc. (DDMPR), and AyalaLand Logistics Holdings Corp. (ALLHC). These selections reflect a balanced approach to investing, blending growth potential, income stability, and ethical alignment.

Portfolio Composition

URC forms the backbone of our portfolio, making up 76% of the allocation. As one of the leading consumer goods companies in the Philippines, URC is well-aligned with Shariah principles and offers strong growth potential. Its diverse product portfolio and market presence ensure steady revenues, making it a resilient choice even in volatile market conditions. URC's focus on sustainable practices and ethical governance further strengthens its appeal for an ethically conscious investor.

Using the TradingView daily chart for Universal Robina Corporation (URC) from the last trading day of the year, December 27, 2024, and retrieved via DragonFi on December 31, 2024, here’s our assessment based on the technical analysis approach discussed in this blog post:

Candlestick Analysis

- A green candlestick (possible elephant bar) is visible near the current price level, showing strong bullish momentum.

- This bar is positioned just above the 20-MA, suggesting that the price is attempting to break through short-term resistance, indicating potential for an upward move.

Moving Average (MA) Indicators

- The 20-MA (blue line) is currently below the 200-MA (red line), confirming that the stock is still in a broader bearish trend.

- The moving averages are relatively wide apart, which signals that the bearish momentum has been strong but may be easing as the 20-MA shows signs of flattening.

Volatility and Momentum

- The narrowing candlestick sizes leading up to the current green bar indicate reduced volatility, often a precursor to a breakout.

- The green candlestick breaking above recent consolidation may signal the beginning of a trend reversal or a short-term bullish correction.

Summary of our Analysis for URC

- Current State: The stock remains in a bearish state (20-MA below 200-MA), but the green candlestick’s position above the 20-MA suggests growing bullish pressure.

- Potential Signal: We are watching for confirmation: if the 20-MA starts to slope upward and the price moves closer to the 200-MA, this may indicate a stronger reversal.

- Actionable Insight: For now, it’s a cautious bullish signal, but traders should wait for additional confirmation before taking further positions.

Comments on our accumulation strategy for URC

Our accumulation of Universal Robina Corporation (URC) stock with an average price of Php78.4623 appears to be a well-considered move, especially given the current technical setup and price levels:

1. Average Cost Relative to Current Price

- With a current price of Php79.00, our average cost of Php78.4623 positions us slightly above break-even. This suggests that our accumulation strategy at different price levels has worked effectively to bring our average cost closer to the current market price.

2. Accumulation Range

- Buying between Php72.6 and Php100 (7 shares, odd lot) reflects a disciplined approach to peso-cost averaging. We took advantage of lower price levels (during the December 23 bearish trend) while positioning for potential upside as the stock approaches recovery.

3. Current Market Signals

- The technical analysis indicates potential bullish momentum with the green candlestick bar above the 20-MA. This may suggest that our accumulation at lower prices (e.g., Php72.6) was well-timed. If the price sustains above the 20-MA and moves closer to the 200-MA, our position may appreciate further.

4. Risk and Opportunity

- Our heavy allocation of 76% to URC implies strong confidence in the stock, but it also concentrates risk in one position. While URC is a resilient, blue-chip company, monitoring its performance closely is critical, particularly if the bearish trend persists.

- On the opportunity side, any breakout above key resistance levels (e.g., Php80–Php85) could signal a stronger uptrend, offering room for significant gains.

Final Thoughts on URC

We have positioned ourselves well for a potential recovery in URC, with an attractive average price relative to the current market. Moving forward, we watch for confirmation of the bullish trend (e.g., sustained movement above the 20-MA and narrowing of the 20-MA and 200-MA gap). Additionally, we shall consider balancing our portfolio if opportunities arise in other securities to manage risk from heavy concentration in one stock.

Representing 14% of our portfolio, DDMPR adds a steady income stream through its dividend payouts. As a Real Estate Investment Trust (REIT), it provides exposure to commercial properties while adhering to Shariah standards. The company's consistent cash flow from long-term lease agreements makes it a reliable asset for income generation, especially in a low-interest-rate environment.

Using the TradingView daily chart for DDMP REIT, Inc. (DDMPR) as of the last trading day of the year, December 27, 2024, and retrieved via DragonFi on December 31, 2024, here’s our assessment based on the technical analysis approach outlined in this blog post:

Candlestick Analysis

- The candlestick patterns around the Php1.03 level indicate a period of consolidation, with small-bodied candles suggesting market indecision.

- There is no clear green elephant bar or red bear elephant bar visible in the recent candles, indicating subdued momentum.

- Recent candles are forming near or slightly above the 20-MA, suggesting that the stock is finding some short-term support at this level.

Moving Average (MA) Indicators

- The 20-MA (blue line) is flattening and aligning closely with the current price, indicating a lack of significant upward or downward momentum in the short term.

- The 200-MA (red line) remains above the price and continues to trend downward, reflecting a longer-term bearish trend.

- The distance between the 20-MA and 200-MA is still noticeable, but it is not as wide as in the earlier months, suggesting that bearish momentum may be losing strength.

Volatility and Momentum

- The small candlestick sizes indicate low volatility, characteristic of a market in a narrow state.

- The flattening 20-MA and price stability suggest that the stock is in a consolidation phase, often a precursor to a breakout.

Summary of our Analysis for DDMPR

- Current State: The stock is in a consolidation phase, with the price stabilizing around the Php1.03 level. The flattening of the 20-MA suggests the bearish trend is weakening but not yet reversing.

- Potential Signal: A breakout above the 20-MA and sustained movement toward the 200-MA (around Php1.09) could indicate a short-term bullish reversal. Conversely, a breakdown below Php1.00 would signal continued bearishness.

- Actionable Insight: For long-term investors like us in Micro Stock Trader, this could be an opportunity to accumulate shares at stable levels while monitoring for any breakout signals.

This assessment shows that DDMPR is at a critical juncture where price action could indicate the next major move. Patience is key to confirming whether consolidation leads to a breakout or further decline.

Comments on our accumulation strategy for DDMPR

Our accumulation of DDMPR stock at an average price of Php1.0504, with prices ranging from Php1.03 to Php1.04, reflects our cautious and steady approach to investing in a stock currently in a consolidation phase. Here's an assessment of our position:

1. Average Cost Relative to Current Price

- With a current price of Php1.03, our average cost of Php1.0504 is slightly above the market level. While we're currently at a minor unrealized loss, this is within a manageable range, given the low volatility and the stock’s dividend-paying nature as a REIT.

2. Accumulation Range

- Accumulating shares between Php1.03 and Php1.04 during the consolidation phase is our reasonable strategy, especially for a REIT like DDMPR, which is primarily held for dividend income rather than capital appreciation.

- By averaging down, we're positioning ourselves to benefit from any potential upward breakout, while continuing to earn dividends that can offset minor price fluctuations.

3. Technical Position

- The 20-MA flattening near our accumulation range suggests that the stock may be stabilizing, reducing the risk of significant downward movement.

- The current narrow state indicates a potential breakout scenario, which could work in our favor if the price moves above Php1.05 and approaches the 200-MA (Php1.09).

4. Portfolio Implications

- With 14% allocation, DDMPR represents a smaller but stable portion of our portfolio. This allocation aligns well with its REIT nature, offering consistent dividend yields to complement the potential for capital appreciation in our more growth-oriented stocks, like URC.

Final Thoughts on DDMPR

Our DDMPR accumulation at an average price of Php1.0504 is our prudent decision for a long-term, dividend-focused strategy. While there is a slight unrealized loss at present, the stock’s consolidation phase and potential for a breakout offer upside. In the meantime, the dividend payouts will provide steady returns, making this a solid addition to our portfolio’s income-generating segment. Micro Stock Trader shall continue monitoring for signals of a breakout above Php1.05–Php1.09 for added opportunities.

ALLHC accounts for 10% of Micro Stock Trader portfolio, offering a strategic entry into the logistics and industrial real estate sector. The company’s commitment to sustainability and its position in a high-growth industry make it a promising Shariah-compliant investment. ALLHC's potential for long-term appreciation complements the stability provided by URC and DDMPR, creating a well-rounded portfolio.

Using the TradingView daily chart for AyalaLand Logistics Holding Corp. (ALLHC) as of the last trading day of the year, December 27, 2024, and retrieved via DragonFi on December 31, 2024, here’s our assessment based on the technical analysis approach discussed in this blog post:

Candlestick Analysis

- A green candlestick is evident at the current price level (Php1.70), showing bullish momentum. The candlestick appears to be a potential green elephant bar, suggesting strong buying pressure.

- This green bar is positioned above the 20-MA, indicating short-term bullish sentiment and potential support from this level.

Moving Average (MA) Indicators

- The 20-MA (blue line) is starting to slope upward and is very close to the current price, signaling early signs of a short-term bullish reversal.

- The 200-MA (red line) is still well above the current price, indicating that the stock is in a long-term bearish trend.

- The gap between the 20-MA and 200-MA remains relatively wide, suggesting that bearish pressure has not completely subsided, but the recent upward movement shows promise for narrowing this gap.

Volatility and Momentum

- The stock recently exited a narrow state, with increasing candlestick sizes indicating growing volatility and momentum.

- The green candlestick breaking above the 20-MA could signal a breakout from the consolidation phase and the beginning of a potential upward trend.

Key Resistance and Support Levels

- Support: The stock has found support at the Php1.65 level, where buyers have consistently stepped in.

- Resistance: Immediate resistance is at the Php1.75–Php1.80 range, with stronger resistance around the 200-MA (Php1.91).

Summary of our analysis for ALLHC

- Current State: ALLHC is showing early signs of a bullish reversal with the price moving above the 20-MA and forming a green candlestick with strong momentum.

- Potential Signal: A sustained close above Php1.75 and continued upward movement of the 20-MA would confirm a short-term bullish trend. A move toward the 200-MA would indicate significant recovery potential.

- Actionable Insight: For investors already holding the stock such as Micro Stock Trader, this could be an encouraging sign to watch for further bullish confirmation. For new investors, this is a phase to cautiously monitor for breakouts before entering.

This assessment highlights the promising technical setup while acknowledging the long-term bearish context, making it an interesting stock to watch for further developments.

Comments on our accumulation strategy for ALLHC

Our accumulation of ALLHC stock at an average price of Php1.6744, with prices ranging from Php1.64 to Php1.71, reflects a well-timed strategy based on the current technical setup. Here’s a detailed assessment of our position:

1. Average Cost Relative to Current Price

- With the current price at Php1.70, our average cost of Php1.6744 puts us slightly under market price, positioning us well for immediate upside potential.

- The current price action, coupled with the green candlestick breaking above the 20-MA, suggests that our entry is aligned with the early stages of a potential bullish reversal.

2. Accumulation Range

- Our buying range between Php1.64 and Php1.71 shows our disciplined accumulation near recent support levels. By spreading our purchases across this range, we’ve managed to average down effectively while minimizing the risk of overpaying.

3. Technical Position

- The price’s movement above our average cost aligns with bullish signals from the chart, including:

- A green candlestick (potential elephant bar) above the 20-MA.

- The upward slope of the 20-MA, indicating improving short-term sentiment.

- If the price sustains above Php1.75 and moves toward the 200-MA (Php1.91), our position could see notable gains.

4. Portfolio Implications

- With a 10% allocation, ALLHC plays a strategic role as a diversification element within our portfolio, balancing the higher allocations in URC and DDMPR. Our exposure to logistics and industrial real estate also complements the broader focus on long-term growth.

5. Potential Risks and Opportunities

- Opportunity: A sustained breakout above Php1.75 could lead to a run toward the 200-MA (Php1.91), offering significant upside. Additionally, the recent bullish momentum increases the likelihood of upward movement.

- Risk: If the price fails to sustain above the 20-MA or breaks below Php1.65, there could be a return to consolidation or further bearish movement. Close monitoring is advised.

Final Thoughts on ALLHC

Our accumulation at an average price of Php1.6744 is well-positioned to capitalize on the current technical signals and potential breakout. The stock’s recent upward momentum aligns with your entry range, giving you an advantage. We shall continue monitoring key resistance levels at Php1.75 and the 200-MA (Php1.91) while remaining vigilant for any reversals in the short-term trend. This allocation complements our portfolio nicely, offering diversification with a promising upside.

Portfolio Strategy

The composition of our portfolio reflects a blend of growth, stability, and income:

- Growth Stock (URC): URC serves as the engine for capital appreciation, driving the portfolio's long-term growth.

- Income Stock (DDMPR): DDMPR provides consistent dividend income, adding stability and cushioning against market downturns.

- Diversification (ALLHC): ALLHC diversifies the portfolio into logistics and industrial real estate, a sector with significant growth opportunities in the Philippines.

Why This Portfolio Works

This allocation is designed to achieve a balance between risk and reward while adhering to Shariah principles. URC offers resilience and growth, DDMPR ensures a steady income stream, and ALLHC brings diversification and long-term potential. Together, they create a portfolio that aligns with both ethical and financial goals, providing a solid foundation for future investment opportunities.

Why a Shariah-Compliant Portfolio Stands Out

A Shariah-compliant portfolio isn't just an investment choice—it’s a statement of values, a strategy for resilience, and a way to contribute to ethical economic growth. Here’s what makes it truly stand out:

1. Values-Driven Wealth Building

A Shariah-compliant portfolio allows you to grow your wealth without compromising your principles. By excluding industries and practices that conflict with Islamic values, these investments promote financial success with a clear conscience, proving that profitability and ethical responsibility can go hand in hand.

2. A Framework for Stability

Shariah compliance inherently filters out high-risk and highly leveraged companies, focusing instead on businesses with sound financial structures. This focus naturally aligns with long-term investors looking for sustainability, making the portfolio resilient even in uncertain markets.

3. Global Opportunities in Ethical Investing

With the PSE now actively identifying Shariah-compliant securities, Filipino investors can participate in a global movement toward ethical investing. Shariah-compliant portfolios are not only attractive to local Muslim investors but also tap into the broader Islamic finance ecosystem, opening doors to international capital markets.

4. Aligning with Broader Economic Goals

By investing in Shariah-compliant securities, you’re also contributing to the broader goal of fostering a more inclusive and ethical investment climate. This supports the growth of businesses that adhere to transparency and fairness while contributing to the local economy.

5. A Portfolio with Purpose

Unlike conventional investing, a Shariah-compliant portfolio gives every investment a dual purpose: to grow wealth and uphold ethical standards. This makes every decision more meaningful, encouraging investors to take a thoughtful, disciplined approach to their financial journey.

How You Can Get Started

Getting started with Shariah-compliant investing is easier than ever, thanks to resources and tools designed to guide you every step of the way. Here’s how you can begin your journey toward building an ethical and profitable portfolio:

1. Identify Shariah-Compliant Securities

The first step is to ensure that the stocks you choose are compliant with Shariah principles. The Philippine Stock Exchange (PSE) has made this process straightforward by maintaining a list of Shariah-compliant securities. This list is created in partnership with IdealRatings, Inc., a globally recognized firm specializing in screening companies for compliance with Islamic finance standards.

Visit the PSE website to access the latest list of approved securities and learn more about the Shariah Stock Market Program.

2. Tips for Building Your Portfolio

Once you’ve identified Shariah-compliant stocks, consider these tips for assembling your portfolio:

- Start Small: If you’re new to investing, begin with a manageable amount to minimize risk as you learn the ropes. For example, we started with an initial capital of Php1,000.00 and gradually expanded our portfolio from there.

- Diversify: Include a mix of growth stocks, dividend stocks, and REITs to balance risk and reward. Diversification helps protect your portfolio from market fluctuations.

- Use Technical Indicators: Apply techniques like candlestick analysis and moving averages (e.g., 20-MA and 200-MA) to refine your stock selection and timing.

3. Choose the Right Platform

Having a reliable and user-friendly trading platform is essential for a seamless investing experience. We use DragonFi LITE in Maya as our online broker and stock trading platform. Here’s why it works so well:

- Convenience: The integration with Maya makes linking your trading account simple and efficient, allowing for easy fund transfers and transactions.

- Responsive Support: DragonFi’s support team is excellent, providing prompt and helpful responses to any concerns or queries.

- Accessibility: With a user-friendly interface, DragonFi LITE is perfect for both beginners and experienced traders looking to manage their portfolios on the go.

4. Stay Informed

Investing is a journey, not a one-time event. Regularly update your knowledge by reading market analysis, monitoring your portfolio’s performance, and staying informed about updates to the PSE’s Shariah-compliant list. Joining forums or communities of like-minded traders can also provide valuable insights and support.

Conclusion

Investing isn’t just about growing wealth—it’s about making choices that align with your values and principles. A Shariah-compliant portfolio offers the opportunity to achieve financial growth while upholding ethical standards, fostering a sense of purpose and responsibility in every decision you make. By prioritizing transparency, fairness, and sustainability, these investments empower you to build a portfolio that reflects both your financial goals and your commitment to doing what’s right.

If you’re ready to take the first step, now is the perfect time to explore the opportunities available in Shariah-compliant investing. With resources like the PSE’s Shariah-compliant securities list and accessible platforms like DragonFi LITE through Maya, getting started has never been more straightforward.

We encourage you to dive in, start small, and learn as you go. The path to building an ethical and rewarding portfolio begins with a single step—and your journey could inspire others to follow suit.

What are your thoughts on Shariah-compliant investing? Do you have any questions or tips to share? Let’s keep the conversation going in the comments below. Together, we can build a community of informed and responsible investors.

RELATED POSTS

Micro Stock Trader: Investing in Asian Terminals Inc. (ATI): What the Technical Indicators Are Telling Us