Categories of stock traders based on buying power

- Starter Trader

- Intermediate Trader

- Advanced Trader

- Professional Trader

- Institutional Trader

- High Net Worth Trader

- Quantitative Trader

As we strive to become profitable traders, it can be helpful to understand the categories of stock traders based on their buying power. This can allow us to evaluate our progress as we advance on our journey toward becoming profitable. While there is no definitive reference material available, we have devised our own categories, acknowledging that they may not be the exact classification. Nonetheless, we propose the following categories:

- Starter: Up to Php10,000 - These traders may be considered "starter" traders who are just beginning to learn about the stock market and have a limited budget for trading. They may start by buying stocks from blue-chip companies or those with a proven track record.

- Intermediate: Up to Php50,000 - These traders may be considered "intermediate" traders who have a bit more experience in the stock market and may have a better understanding of technical and fundamental analysis. They may be more willing to take on higher-risk investments and may start to diversify their portfolio.

- Advanced: Up to Php100,000 - These traders may be considered "advanced" traders who have significant experience in the stock market and may have a more thorough understanding of both technical and fundamental analysis. They may have a more diversified portfolio and may be involved in day trading or swing trading.

- Professional: Php500,000 - These traders may be considered "professional" traders who have a significant amount of experience and capital and may be trading on a full-time basis. They may have access to advanced trading tools and platforms, as well as a team of analysts and researchers to assist with investment decisions.

- Institutional: Php1,000,000 - These traders may be considered "institutional" traders who have a significant amount of trading funds and may be trading on behalf of a company or organization. They may have access to advanced trading tools and platforms, as well as a team of analysts and researchers to assist with investment decisions.

- High Net Worth: Php5,000,000 - These traders may be considered "high net worth" traders who have a significant amount of capital and maybe trade as a form of alternative investment. They may have a diversified portfolio and may be involved in a range of trading activities, including stocks, options, and futures.

- Quantitative Trader: Php10,000,000 or more - These traders may be considered "quantitative traders" who use algorithmic trading and quantitative analysis to identify trading opportunities and make trading decisions. They typically have advanced programming skills and may work for hedge funds or investment banks.

The Intermediate Stock Trader

Our current investment portfolio is valued at precisely Php25,636.37, encompassing all of our modest savings. The portfolio is comprised of the following assets:

Banks:

- BDO UNIBANK, INC.(BDO)

- BANK OF THE PHILIPPINE ISLANDS (BPI)

Commercial:

- ACEN CORPORATION (ACEN)

Conglomerates:

- ABOITIZ EQUITY VENTURES, INC. (AEV)

- SM INVESTMENTS CORPORATION (SM)

Consumer:

- JOLLIBEE FOODS CORPORATION (JFC)

- UNIVERSAL ROBINA CORPORATION (URC)

Property:

- AYALA LAND, INC.(ALI)

Searching for Online Stock Trading Strategies

As our entire portfolio is currently experiencing a downtrend, we have been afforded ample time to reflect and strategize for our next move. As novice traders, we recognize the value of seeking counsel from industry experts.

We have explored numerous blogs, websites, YouTube tutorials, and other resources, and we have found one particular voice that stands out from the rest. This voice resonates with us on a deeper level, providing a unique perspective that aligns with our investment goals and values.

In his Commitment Statement, OLIVER VELEZ recounted his personal journey of entering the world of trading in 1981, and officially turning professional in 1986. He shared that the initial years were arduous and lacked any available resources or mentors to guide him. Despite the difficulties, he persevered and learned through trial and error. This pursuit for excellence demanded significant time, financial, and personal sacrifices. However, he achieved consistency and success, leading him to share his methods with other professional traders in 1994. This move broke the traditional rule of secrecy that previously shrouded the industry. His story serves as an inspiration for aspiring traders and highlights the value of perseverance and determination in achieving success.

While we do not claim that the expert's teachings are infallible, we also acknowledge that they cannot be entirely disregarded as nonsensical. Based on the extensive collection of tutorials and authored books we have reviewed thus far.

Stock Trading Tactics for Live Testing

We have compiled a list of ideas that we find compelling and intend to explore for ourselves. We have taken the liberty of interpreting these concepts based on our understanding of how they can be effectively applied to our trading goals.

We need four things to start to be profitable in trading:

- Php50,000 to Php100,000 online trading account

- Candlestick chart

- 20-Moving Average (simple)

- 200-Moving Average (simple)

Starter Level: Php50,000 to Php100,000

- It is a common saying that it takes money to make money in stock trading.

- Although some online trading accounts have no minimum deposit requirements, such as BPI Trade, or a minimum of Php1,000.00, like COL Financial, buying stocks for under Php1,000.00 to own 100 shares is not cost-effective.

- It is better to save and hold your cash until you reach a buying power of Php10,000.00 or the Starter Level Trader based on our suggested categories.

- Trading with a small amount of money is a guarantee for failure because it can lead to incorrect trading decisions.

- Based on our local interpretation, we recommend having a proper amount of Php50,000.00 to Php100,000.00 to play in the equity markets.

Candlesticks and Technical Indicators

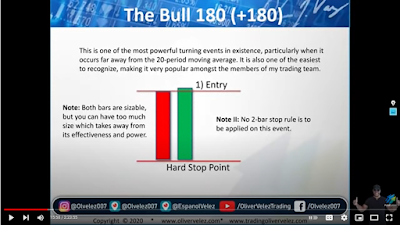

- We shall be on the lookout for "The Bull 180 (+180) shown below:

- Here is the illustrated tactic for the "Bull 180 (+180) Near" in the screenshot:

Tips and Strategies for Application

- Take time to search and learn different trading tactics to help you find what works for you.

- Test your trading tactics before implementing them fully to determine their effectiveness.

- Move your account up in value responsibly by trading with skill, self-discipline, and self-control.

- Understand the delineation of responsibilities: the stock's responsibility is to go up in value, the market's responsibility is to make money, and the trader's responsibility is to stop trading when the market is not performing well.

- Analyze your losing trades to gain insights into your trading style and adjust accordingly.

- Follow the number one rule of trading: do not lose money. Set a maximum loss per day and stick to it.

- If you have to lose money, make sure it is within your set maximum loss per day to minimize your losses and maximize your chances of recovery.

- Aim to make your first Php3,000.00 from Php50,000.00 to become an Advanced Level Trader.

By following these guidelines, we hope to become successful traders with a responsible and disciplined approach to the market. Remember that trading requires patience, perseverance, and continuous learning. With dedication and a strategic mindset, you can achieve your financial goals and become a successful trader.

In conclusion, stock trading can be a lucrative investment opportunity, but it requires proper knowledge, skills, and capital to succeed. It is essential to learn from the experts and develop a sound trading strategy based on a thorough understanding of the market. While it may be tempting to start small, investing a small amount of money may not be cost-effective and could lead to failure. Therefore, it is advisable to save and hold your cash until you reach the appropriate buying power to play in the equity markets, which we suggest to be around Php50,000.00 to Php100,000.00. Remember that stock trading is a long-term investment that requires discipline, patience, and a sound financial plan to reap the rewards in the end.